What is ABSD?

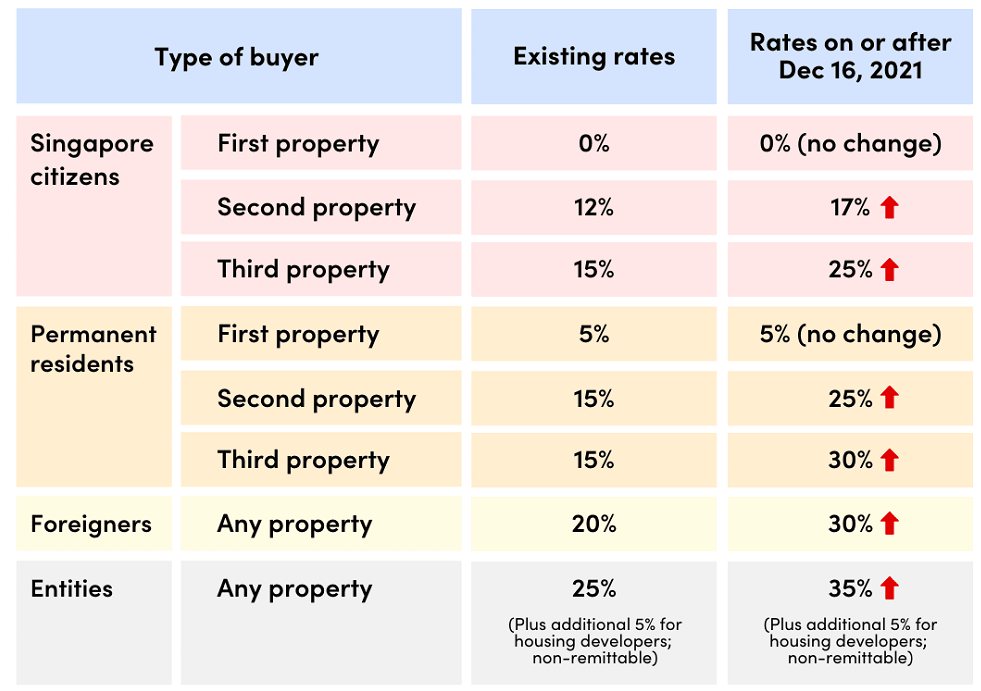

Additional Buyer’s Stamp Duty, Inheriting Property or ABSD for short, has been in effect since 2011 as part of the property cooling measures aimed to cool down the red-hot housing market. ABSD fees are exclusive to residential properties.

Other market-cooling measures include Seller’s Stamp Duty (SSD), modifications to the Loan-to-Value ratio, etc. The TDSR (Total Debt Servicing Ratio) Framework was implemented in 2013 to encourage safe lending and borrowing practices.

Property owners and investors must consider the ABSD while planning their next real estate purchase. This essay will examine the potential effects of the ABSD on property inheritance.

Example: Are beneficiaries with current properties have to pay the ABSD in order to inherit a second property?

In the case of a direct inheritance, with or without a Will, neither the Buyer’s Stamp Duty (BSD) nor the Additional Basic Stamp Duty (ABSD) would apply.

Mr. Tan is a widower with three children, and each child owns a separate property. He passed away without a Will, and his children will receive his possessions equally. In this situation, the children can inherit the property free of BSD and ABSD.

Each child would now own two properties, while the inherited property would be co-owned by all three children. This will increase their ABSD liabilities when they acquire further real estate.

However, if two of the children choose to sell their portion of the inherited property to their eldest sibling, he will be required to pay ABSD to acquire their share, as he already owns one property.

This may not be the best option because more taxes must be paid. Mr. Tan might have saved his children time and money by preparing the succession of his property.

Mr. Tan can, for instance, evaluate the financial needs of his children and leave the property to the one with the greatest need. He can then leave cash equivalent to the property’s worth to his two other children. He may also establish the estate through insurance.

This would ensure that Mr. Tan’s children can inherit his estate without tax complications. Alternately, he may advise the Executor of the Estate to sell the property and divide the money as appropriate. Nonetheless, if Mr. Tan desires that his property be passed down to future generations, this strategy may not be appropriate. Additionally, Seller’s Stamp Duty (SSD) and Total Debt Servicing Ratio (TDSR) must be taken into account.

Due to the high percentage of property ownership in Singapore, property owners must strategize their property succession in order to ensure that their heirs can inherit the estate without paying additional costs.

To find out more about legacy planning through real estate, you could reach us at 98577596 (KIA) or 91688960 (CATHERINE)