Private domestic fees and HDB resale expenses endured to upward push, albeit at a slower tempo inside the first zone of 2022, following the advent of the latest belongings cooling measures in December 2021 that have been geared toward stabilizing the marketplace and reining in buying demand from foreigners and investors with multiple houses. The slowing price growth got here amid a pullback in sales volumes as uncertainties loom. Check our Latest Projects Here

Why? New Cooling Measures In This Year

Q1 2022 private Residential property Index (Flash Estimate)

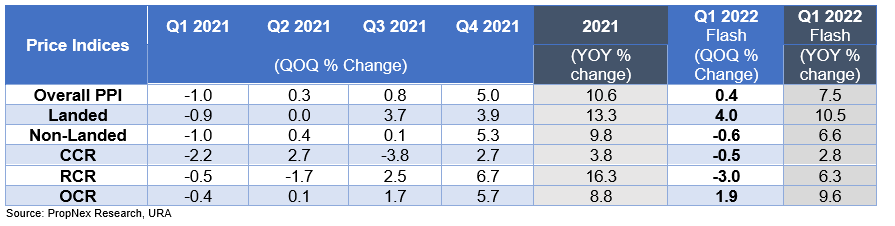

The flash estimate from the Urban Redevelopment Authority (URA) showed that usual non-public home prices rose for the eighth immediate region in Q1 2022, inching up with the aid of 0.Four% QOQ – markedly slower than the 5% QOQ boom inside the preceding region. You can search on Google related to this topic and you will find a lot more information

Apart from the cooling measures, a mixture of things additionally contributed to the gradual charge increase in Q1 2022. These covered a dearth of latest task launches, diminishing inventory of unsold suburban new homes in addition to the upward thrust of Covid-19 network instances added by means of the omicron variant, which had impacted domestic viewings and dampened the non-public resale marketplace.

The charge increase in Q1 2022 changed into led through the landed personal houses section, which grew by way of 4% QOQ. This became pushed through the landed resale marketplace in addition to the new strata-landed task launched at some stage in the zone – Belgravia Ace – which had sold gadgets at a median transacted charge of $four.4 million, likely boosting landed home values.

Typical charges in the segment of the non-landed house contracted in Q1 2022 by using -zero.6% QOQ, with charges of homes within the central place, largely slipping because of softer investor and foreigner call for in addition to constrained viewing interest because of the outbreak of COVID-19 community cases.

Prices within the center central area (CCR) slipped by using -zero.5% QOQ in Q1 2022. Values of high-end homes in the CCR may also maintain to melt inside the near-time period because the cooling measures weigh on calls from buyers and foreigners.

In the rest of the central area (RCR), home costs fell by -three.Zero% QOQ – reversing from the 6.7% QOQ growth posted inside the previous region in which the release of Canninghill Piers at benchmark charges of almost $2,900 psf had boosted values in the RCR in this autumn 2021. Activity within the RCR marketplace has been pretty muted in Q1 2022 because of the shortage of new launches, most of the sales transactions throughout the quarter got here from formerly-launched tasks along with Normanton Park, road South residence, and One Pearl financial institution.

While costs in the relevant location had slipped, non-landed houses within the outside primary area (OCR) bucked the trend. Costs endured growing in Q1 2022, supported largely by way of calls from nearby homebuyers. Non-landed private home charges within the OCR grew with the aid of 1.9% QOQ, albeit at a slower clip than the preceding zone’s growth of five.7%. The moderation in fee growth can be attributed to the tighter unsold stock and restrained new launches which had probably crimped home sales and fee increases inside the OCR.

Based on Realis caveats statistics up till twenty-second March 2022, extra than 1,500 new personal houses (ex. ECs) and approximately 2, six hundred non-public resale residential gadgets changed fingers in Q1 2022 – a sharp decrease from the three,018 new houses and four,748 resale houses transacted inside the previous area.

“The private residential market got off to a slow start in 2022 after what become a thrilling overall performance remaining 12 months. The cooling measures have virtually helped to tame fee increase in Q1 2022 to an extra sustainable tempo.

Typically, new launches assist to enhance domestic values. So, the moderation in the normal price boom changed now not surprising given the restricted variety of latest launches at some stage in the zone. We estimate that developers placed out a few hundred devices of the latest personal homes for sale in the final area – some distance fewer than the three,716 new houses released in Q1 2021 and 2,275 devices released in this fall 2021, according to URA data.

Over within the resale market, transaction volume has softened in Q1 2022, as the Chinese New yr festivities and the Omicron wave likely disrupted viewings and income activities during the sector. A few customers could also have held again on property buy to monitor the impact of the fresh cooling measures delivered in December 2021.

In addition, the extent of uncertainties rose drastically in Q1 2022, with the escalation of the Russian-Ukraine struggle, which allows you to likely exacerbate inflation woes and the worldwide delivery chain disruption. Those uncertainties may also have weighed on marketplace sentiment and shopping for hobbies at some point in the zone. Any other drawback chance to look at is growing interest charges – a much steeper borrowing value might also negatively impact sales.

Notwithstanding these risks, we anticipate the private housing market to remain pretty resilient this 12 months and expenses may want to develop with the aid of 3% to 5% in 2022, as HDB upgraders and neighborhood customers assist to underpin sales and the confined unsold stock should lend assist to domestic values. Singaporeans persevered to form the bulk of personal housing call for in Q1 2022, accounting for 82% of non-landed non-public new income and 76% of non-landed private resale transactions during the zone.

Moreover, the relaxation of community safe management measures and easing of journey restrictions will bode properly for the assets market, facilitating income in the show apartments and probably spurring sales from more overseas buyers, who’re capable of going to and thinking about homes. In Q2 2022, we expect numerous new tasks to be launched for sale – which includes North Gaia EC and Piccadilly Grand – for you to assist with power income and preserve charges. With growing inflation and higher production price, we count on expenses of recent launches to stay firm.”

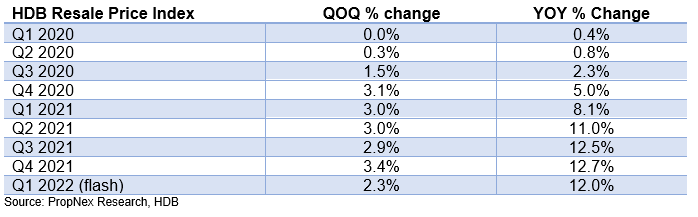

Q1 2022 HDB Resale Price Index (Flash Estimate)

The flash estimate released via the Housing and Development Board (HDB) showed that resale charges of public housing apartments rose by means of 2.3% QOQ in Q1 2022 – moderating from the 3.4% growth in q4 2021.