Intelligent investors are well aware that a crisis should never be wasted. Obviously, the majority of us dislike crises since they can be unpleasant, yet crises do occur from time to time, and when they do, what is your next step? Are you courageous enough to enter the property market while others are hesitant to do so?

Fear and insecurity tend to speak louder at times of crisis, drowning out any logical reasoning. For instance, you have completed all the necessary research and financial preparation and are confident that you can afford a particular property, but fear prevents you from purchasing it. Now you may be wondering: Is it risky? Will prices fall precipitously? Or, even worse, will the market crash? When there are uncertainties on the horizon, it is normal to have these ideas, but be mindful that they can obscure your judgment.

In contrast, there is a second set of questions you should consider: Will I miss out on attractive buying chances brought about by the crisis? Can I take advantage of the price moderation? What are the prospects for capital gains once the crisis subsides and the market recovers? There are always two sides to a story, and it is essential to acquire the correct knowledge to make informed decisions.

The crucial question: Is there currently a crisis?

In my opinion, we are not yet in a state of crisis, but there are more uncertainties on the market as a result of the new cooling measures, the Russia-Ukraine conflict, the possibility of slower global growth, rising prices, supply chain disruptions, interest rate hikes, and Covid-19. This is a lot of information to process, and some property purchasers may prefer to wait it out. However, what is the opportunity cost of inaction? Even though these are unpredictable times, we must examine the market’s fundamentals to have a better understanding of its future.

What is the history of Singapore’s real estate market?

The Singapore housing market has proven to be resilient, displaying its ability to endure adversity and achieve long-term growth. Examine the Urban Redevelopment Authority’s property price index instead of simply taking my word for it (PPI). At first glance, there are ups and downs, indicating the cyclical market cycle (Chart 1) – but if you examine the troughs, you can find that even when prices sank, they were still higher than the prior low point. The same holds true for peaks. We like to remark that the low is greater than the prior low and the high is more than the previous high.

This indicates that home values are generally on the rise, and buyers could certainly experience price increase if they hang on to the property for an extended period. In fact, private home values reached a new peak in the fourth quarter of 2021, so if you purchased a home during one of the prior crises, you would likely be sitting on substantial gains.

Positioning yourself to profit from price appreciation

If you know the property you want, if you have a clear understanding of your purchasing or investment purpose, and if you have done your calculations, you will be able to act swiftly when an excellent opportunity presents itself. The key is still being made. Therefore, it is advisable to communicate frequently with Kia & Catherine in order to stay abreast of the ever-changing market trends.

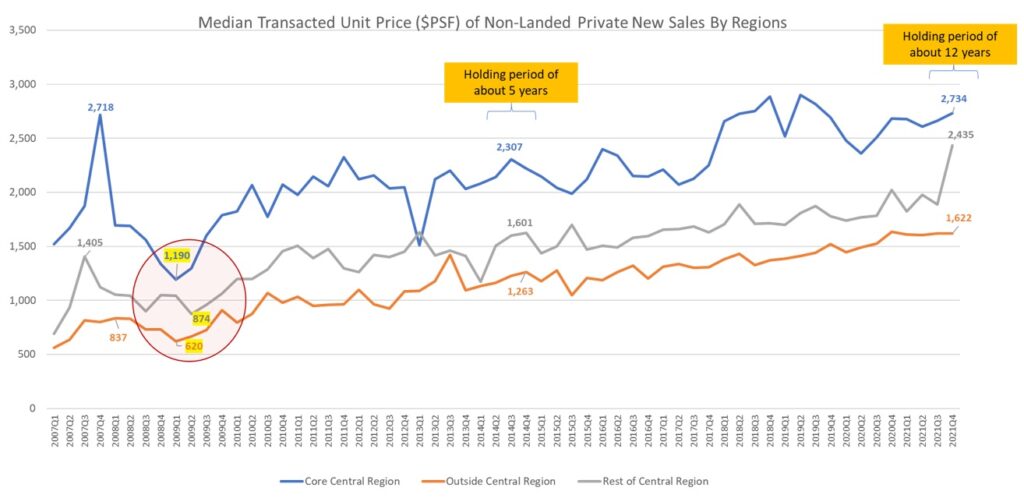

Although we are not technically in a crisis, there are sufficient market uncertainty to unnerve some purchasers. Referring to the previous major crisis (Chart 2) – the Global Financial Crisis (GFC) of 2008/09 – it can be seen that buyers who purchased a new private home in 2009 when prices were falling would have realized significant price appreciation if they had sold their properties after a 5-year holding period.

According to Realis caveats, if they had held onto their properties for another 12 years and sold them in the fourth quarter of 2021, they would have realized even greater returns.

If you have holding power, you will be able to withstand adversity and profit from price growth over time. This is why we recommend real estate investment as a strategy to increase your wealth, establish financial independence, and save for retirement.

Looking at Chart 2, one may wonder whether prices may correct sharply in the next months. Should I wait till prices drop before purchasing? You may be dismayed to learn that we do not anticipate a major decline in private home prices; in fact, we still anticipate a slower price increase of 3 to 5 percent this year, compared to 10.6 percent in 2021.

Why? Well, land prices play a significant role. Developers have purchased property at a premium price over the previous year, and with rising construction and labor expenses, there is little likelihood of significant price reductions.

HDB upgraders and Singaporean first-time homebuyers who are less affected by the new cooling measures will continue to support new home sales. With limited unsold inventory on the market and robust demand, we do not anticipate developers to reduce prices in the near future. Given the expensive land and increased costs, it is probable that fresh launches will set new benchmark prices. The expected increase in the Goods and Services Tax may also contribute to growing construction prices. Will you ultimately be required to pay significantly more if you wait?

Buying a home is the biggest investment in our life and a long-term commitment. We are aware that some investors and buyers may find it challenging to analyze the data and numbers on their own. If you require assistance with your real estate planning, please call Kia 98577596 or Catherine 91688960.