You can’t afford to wait into market, because you snooze, you lose…

The adage “Good things are worth waiting for” does not apply to home purchases.

Many times in life, it is true that one must be patient in order to reap the benefits. Unfortunately, it doesn’t work that way with homes. Housing prices continue to rise; you don’t need to read the article to know that.

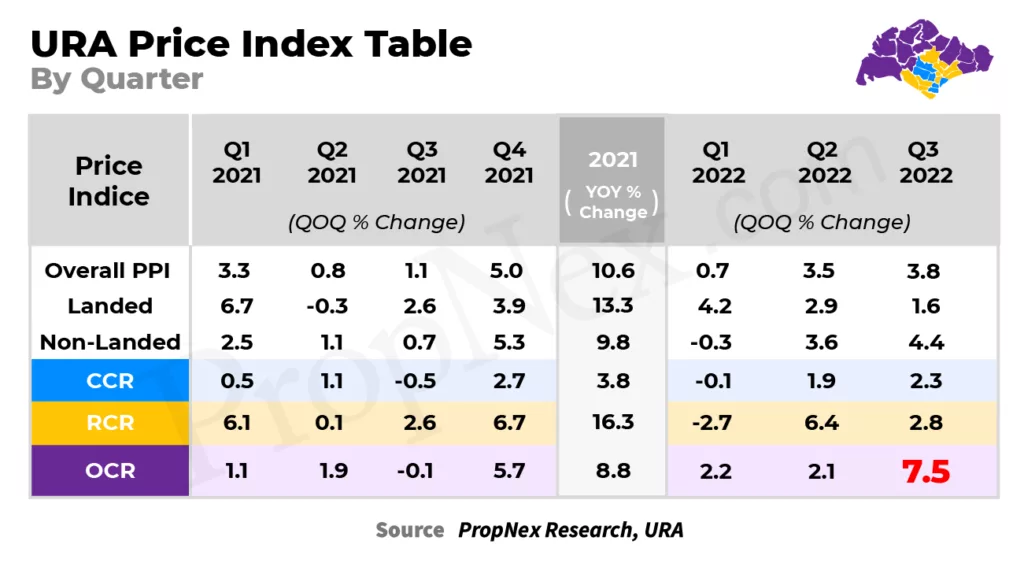

The most recent numbers from the Urban Redevelopment Authority (URA) show that private home prices increased for the tenth consecutive quarter in Q3 2022, rising by 3.8% from Q2 2022. Private housing prices increased by 8.2% from the end of 2021 through the first nine months of 2022.

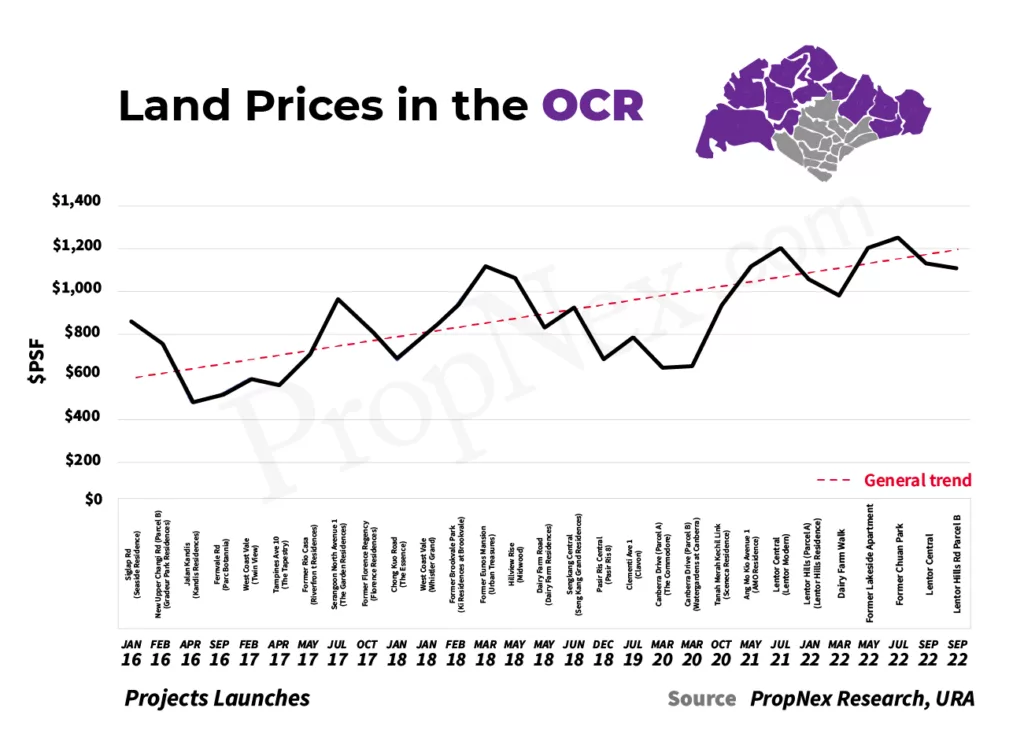

The proof: OCR setting new standards

Private homes in the Outside Core Region (OCR), which saw an increase of 7.5%, fared the best in the most recent quarter, as can also be clearly seen. Earlier this year, in July, Amo Residences was introduced. On the day of the launch, a startling 98% (362 units) of the available units were sold at a median price of $2,113 per square foot. The following two launches within the OCR in September, Sky Eden@Bedok and Lentor Modern, both moved 76.6% or 121 units at a median price of $2,118 psf and 84.6% or 512 units at a median price of $2,108 psf, respectively, adding to the incredible results that quarter.

Due to the three successful launches, we observed that the average price of launches in the OCR exceeded $2,000 per square foot. This represents the acceptance by homebuyers that paying more than $2,000 per square foot for an OCR project may become the new standard.

Let’s look at some of these factors that are causing real estate prices to rise.

This one’s the biggest culprit by far

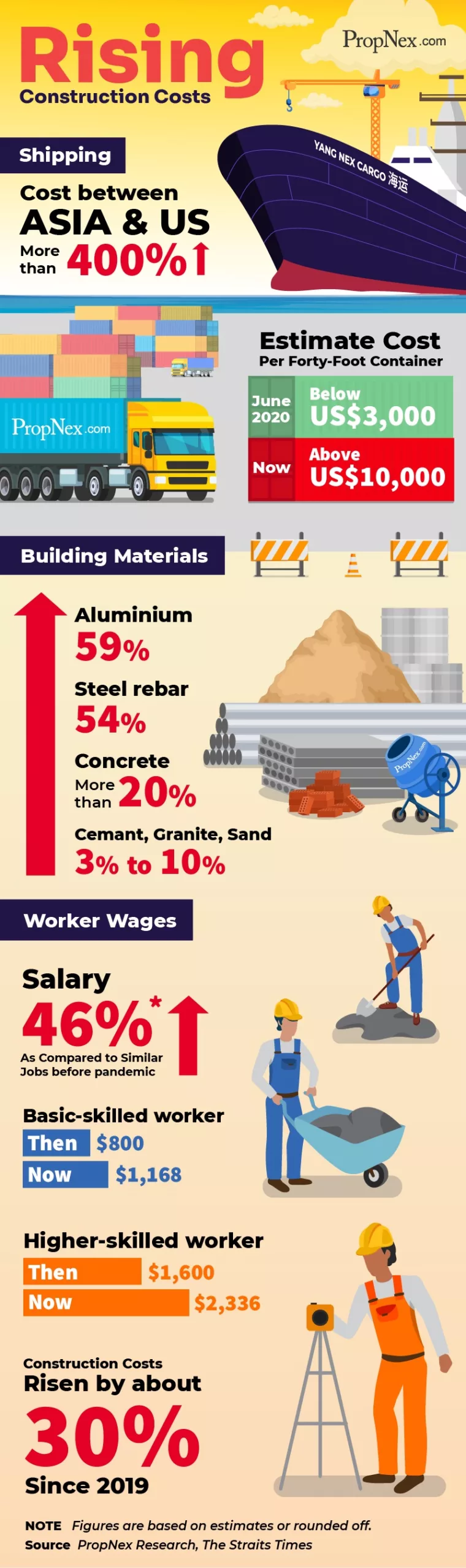

Since the pandemic began, construction costs have steadily risen, reaching all-time highs in 2022. Increased material costs, a shortage of available workers, and price increases have created a never-before-seen crisis in the construction industry. As a result of these factors, building costs have risen by at least 30% since 2019.

As a result of the pandemic’s interference with the supply chain, businesses in the sector are currently playing catch-up in order to meet consumer demand. Raw material prices and global crude prices both shot up as a result of the conflict between Russia and Ukraine. Shipping and the manufacturing of building supplies both rely heavily on crude oil, making it a crucial resource for the construction industry. Look at how the pandemic and the subsequent war have driven up prices over the past few years.

Cost of Government Land Sales

Every year in March and September, the government publishes a list of land parcels available for development projects through the Government Land Sale (GLS) programme. Anyone interested in developing the land is welcome to submit a bid through an open tender.

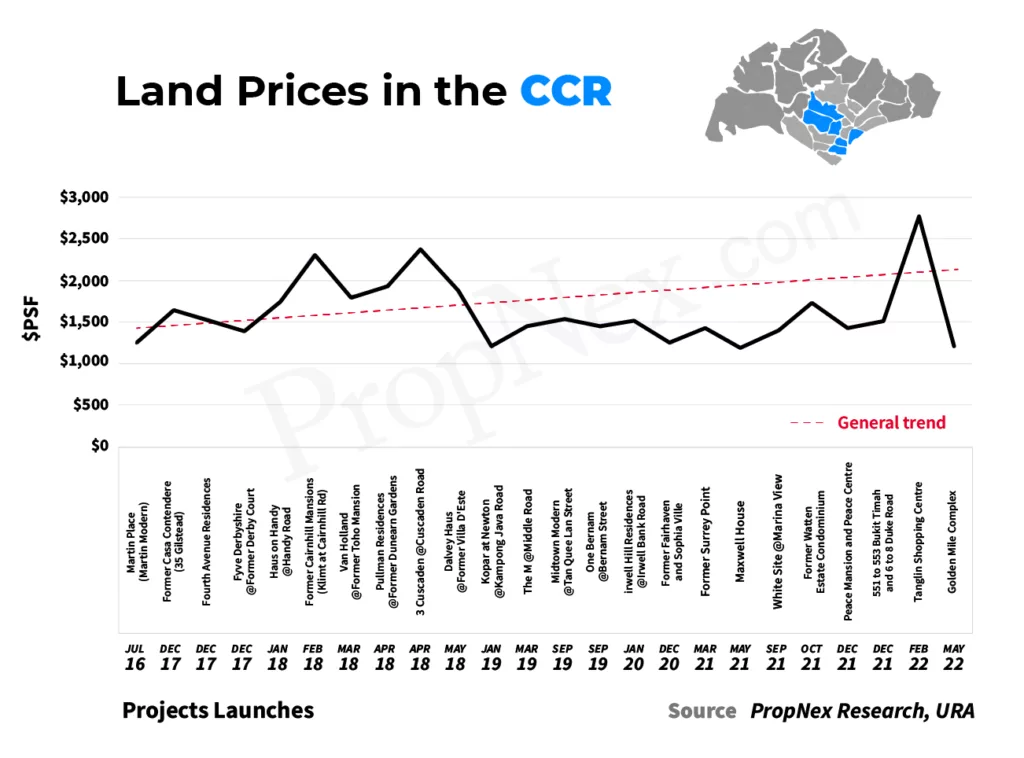

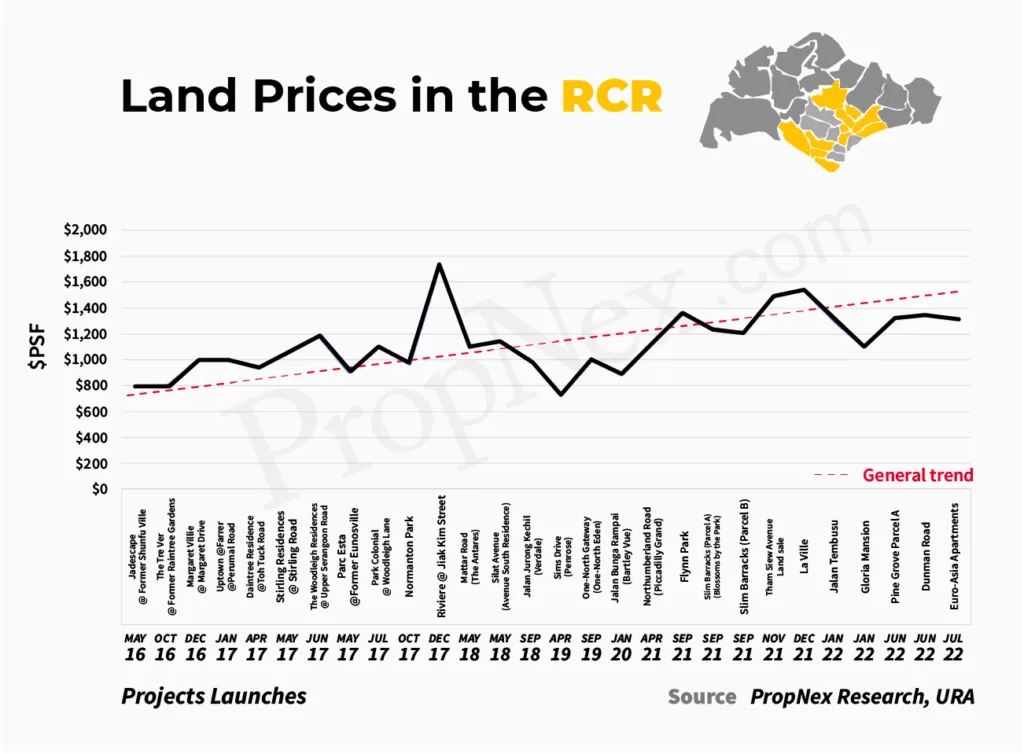

In order to secure the land parcels on which to construct their new projects, developers engage in a land bidding war. The price at which developers can acquire land may also have an impact on the final cost of a project. Price increases are likely for in-demand land areas because of the greater interest they will attract.

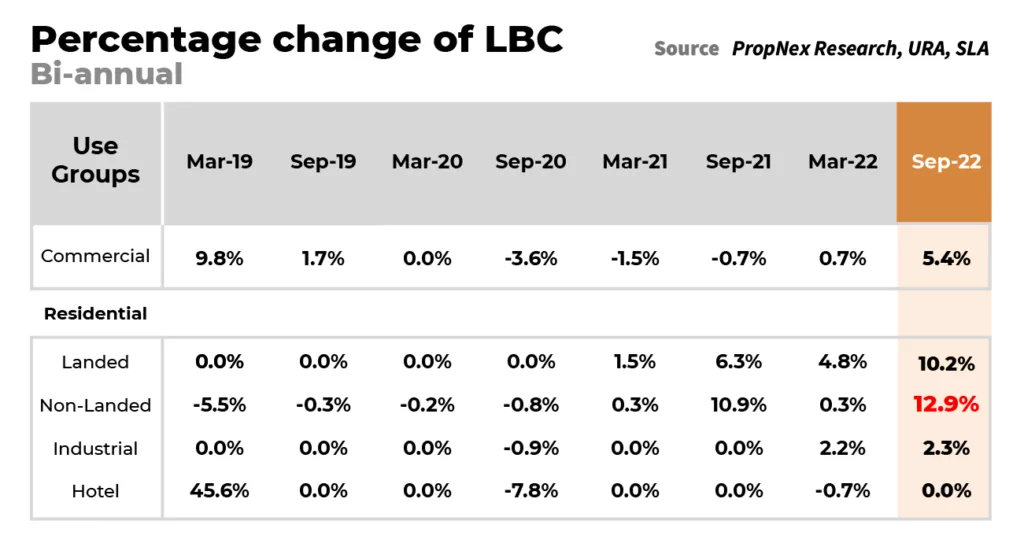

It is clear from the three graphs below that land prices are increasing, and that this trend is being felt by homeowners.

The Brand-New Fees

Before being renamed Land Betterment Charge (LBC), the Development Charge (DC) was a tax that developers in Singapore had to pay to the Singapore Land Authority (SLA) in order to build on land that would increase in value as a result of their work. Given that our current emphasis is on residential construction, LBC’s ability to modify the plot ratio so that more condos can be built is a good illustration of how this system can be put to use.

Different types of developments attract different LBC rates, and the area itself is divided into 118 different price brackets. LBC fee adjustments, like GLS site disclosures, occur twice yearly, in March and September. The following table shows that there were sizeable increases in the rates of the most recent round of LBC, which was released in September, with the largest increase being seen for non-landed residential projects.

Don’t let it slide

As we go about our daily lives in the aftermath of the pandemic, industries like shipping and construction are scrambling to get back to normal. They may eventually return to normalcy, but a period of increased expenses is inevitable as they do so. The ongoing conflict between Ukraine and Russia has already had a negative impact on global commodities like crude oil, which is used in far too many aspects of our daily lives to be ignored. It’s bad enough that inflation is happening alongside everything else.

Since it’s virtually guaranteed that home prices will keep going up for the foreseeable future, the best time to buy a house was yesterday. However, it’s possible to find solutions to the problem of ever-increasing prices, interest rates, and inflation.