Calculating Gross Rental Yield Calculator In Singapore

Steps: To Understand Rental Yield Calculator In Singapore

- Consider your monthly rental income (or estimated income)

- To calculate your annual gross income, multiply your monthly income by 12.

- Subtract the total annual property costs to calculate your annual net income.

- Divide the total by the amount you spent (or will pay) for the property.

- To convert this amount to a percentage, multiply it by 100.

- Your net rental yield is the solution.

Example With Rental Yield Calculator In Singapore

If you buy a property worth $200,000 and you rent it out for $1,000 a month, your gross rental yield is 6%. Rental Yield Calculator In Singapore See each step of the calculation below:

((1,000 × 12) ÷ 200,000) × 100

(12,000 ÷ 200,000) × 100

0.06 × 100 = 6%

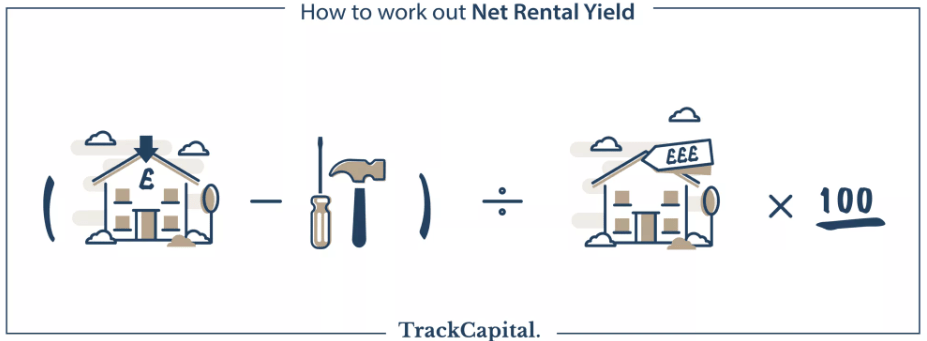

Calculating Net Rental Yield Calculator In Singapore

The second type of rental yield is net. Net yield is the return (or potential return) of a rental property after costs, e.g. maintenance, insurance, tax. You can calculate the net yield of any property with the following formula:

(((Monthly Rental Income × 12) – Costs) ÷ Property Value) × 100 = Net Rental Yield

Steps: For Rental Yield Calculator In Singapore

- Take your monthly rental income (or estimated income)

- Multiply the monthly income by 12 to work out your annual gross income

- Minus the total costs for the property over the year to work out your annual net income

- Divide the resulting sum by the price you paid (or will pay) for the property

- Multiply this figure by 100 to convert it into a percentage

- The answer is your net rental yield

Example For Rental Yield Calculator In Singapore

If you buy a property worth $200,000 and you rent it out for $1,000 per month, with expenses of roughly $3,600 per year, then your net rental yield is 4.2%. See each step of the calculation below:

(((1,000 × 12) – 3,600) ÷ 200,000) × 100

((12,000 – 3,600) ÷ 200,000) × 100

(8,400 ÷ 200,000) × 100

0.042 × 100 = 4.2%

Net vs Gross yield – Which Should I Use?

Net rental yield is more difficult to assess because costs are changeable and difficult to estimate. Having a rough concept of net yield is still useful because it provides a more accurate picture of your return on investment.

In comparison, gross rental yield is fairly simple to calculate. It can be done on the go when studying a potential investment without the need to evaluate expenditures.

Investors may also benefit from comparing gross and net yields. The difference between gross and net should be no more than 1-2% as a general rule. A wise investor will look for potential cost savings or consider increasing the monthly rental price for properties with a larger difference.

Working out this difference has the extra benefit of identifying the best and worst performers in a multi-property portfolio. The lowest performers may be attractive candidates for selling, as you may reinvest the proceeds elsewhere for higher returns.

Calculating and Tracking Rental Yields Over Time

Every property investor, whether a residential buy-to-let investor or a commercial property owner, should maintain a spreadsheet to track rental yields over time. If you don’t have all of the data, it’s fine to fill in the blanks with estimations; nonetheless, you’ll develop a historical record of yield performance over time.

And this is a useful dataset as you move through your real estate experience.

Final Summary & Thoughts

- Rental yield is a metric for determining rental profitability.

- There are two kinds: gross yield and net yield.

- Gross yield is calculated before expenses, and net yield is calculated after expenses.

- The discrepancy between both the two should not exceed 1-2%.

- Both can be used to evaluate new investments and track the performance of your portfolio.

- Good rental yields typically range from 5 to 8%.

- If your yields are low, you may not be producing enough to cover all of your expenses, therefore you should think about ways to increase profitability.

FAQs Some of Questions For Rental Yield Calculator In Singapore

What’s a good rental yield?

Recap: What’s a good rental yield? Anywhere between 5-8% is a good rental yield. Work out your rental yield by dividing your annual rental income by your total investment – or use a yield calculator.

Why does rental yield matter?

Good rental returns hold great importance when it comes to real estate investing. Your rental income should be enough to cover unforeseen expenses, which are more commonly known as budget buster and are associated with the maintenance and taxation on your owned property.

How can I increase my rental yield?

Re-assess your rent. Review your outgoings. Add a bedroom. Refurbish/redecorate. Cater to a specific lifestyle. Improve storage. Consider allowing pets. Aim for long-term lets.

What Is Progressive Payment Scheme ?

Check Latest Progressive Payment Scheme In Singapore

What About House Loan Information In Singapore?

You can check the Housing Loan Information In Singapore