The year 2021 was a phenomenal one for sellers, as property prices reached all-time highs. As a result of the Covid-19 pandemic’s effects on tourism and uncertainty on the financial markets, Rising interest rate many have turned to the real estate market. Delays in construction and rising material costs, resulting from disruptions in the global supply chain and a labor shortage, added fuel to the raging blaze and exacerbated its intensity.

This enormous increase in demand relative to the diminishing supply has compelled many purchasers to purchase the unsold inventory, pushing it to reach a record low of 19,409 in the second quarter of 2021. Homebuyers were further tempted by their increased purchasing power as a result of record-low loan rates.

Fast-forward to the present, as the economy is moving towards recovery, there are plans by the US Fed to hike interest rates again. As most of you are likely aware, Singapore’s interest rates closely track the fluctuations of the Federal Reserve’s interest rate. How will the impending increase in interest rates impact you?

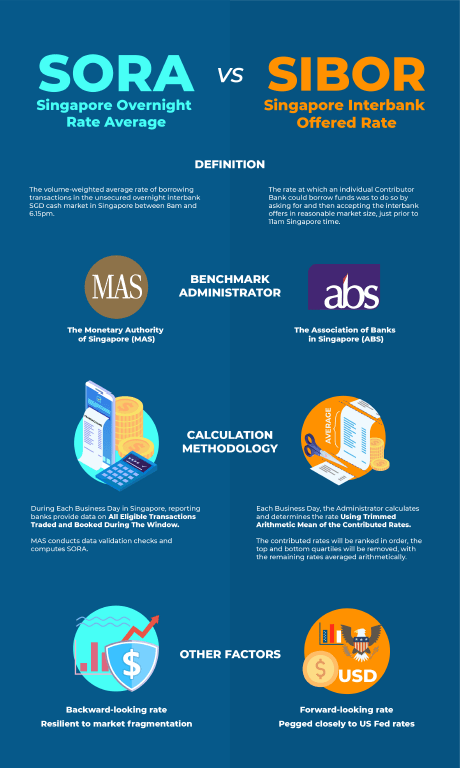

To better understand this, let’s first take a look at the types of interest rates offered here in Singapore.

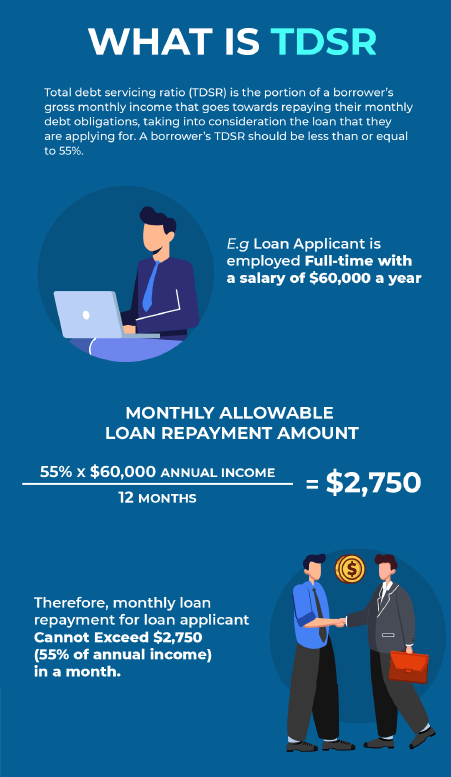

What is Total Debt Servicing Ratio?

The Total Debt Service Ratio (TDSR) is a financial safety measure implemented by the Singaporean government to ensure that its citizens do not overleverage and have the financial means to repay their loans.

The impacts of rising interest rates

Consumers fear an increase in interest rates because it impacts the total amount homebuyers must pay after factoring in the accrued interest on their mortgages. What if I told you that whether the interest rate is rising or falling has negligible impact on your property, assuming you’ve made calculated decisions while purchasing your home? When interest rates are expected to rise, many believe it’s a bad time to consider purchasing a home, but the statistics and examples below will illustrate the reality regarding the relationship between the housing market and interest rates.

As shown in Figure 1, real estate prices have increased during the previous two decades. Since 2010Q1, interest rates have been very stable, with the exception of 2015Q1, when they began to rise, and then fell again when the pandemic struck.

Does this imply that consumers who purchased homes between 2015Q1 and the epidemic lost money when loan rates leveled out over the past two years? You will be astonished to learn that not only did they not incur a loss, but numerous purchasers made quite profitable returns. In the same manner as the purchasers of Twin View in Figure 2 below, who purchased their home during one of the interest rate peaks in 2018 and sold it for close to $500,000 in 2021. Mortgage interest rates may be one of the most significant factors to consider when acquiring a home. Few, however, realized that it should not be the most crucial criterion to consider when selecting a property that will yield profitable returns. The preceding case study demonstrates conclusively that rising borrowing rates did not inhibit the expansion of a well-planned and chosen property.

The unit at Treasure @ Tampines in Figure 3 below, which was purchased while interest rates were high in 2019Q2 and yielded $416,000 in less than three years, is yet another illustration. Instead of worrying about interest rates, you could be in this position if you understood just what to buy and when. Ultimately, the rise in home values dwarfs the increase in interest rates.

To comprehend why interest rate increases are not causing the property market to collapse or stagnate, one must first comprehend why interest rates are rising.

In reality, it is common knowledge that inflation has led to a rise in the cost of nearly all goods and services, including real estate. And one of the most effective means for the monetary authority to combat inflation is to increase the interest rate. Therefore, even if there is no growth in the real estate market during the next few years, inflation may cause property values to increase.

What are the implications for homebuyers? Concentrating on the incorrect objective may incur a greater opportunity cost. The rising interest rates and other trigger factors should signal to investors and homebuyers that it is time to take prompt action. It is extraordinarily difficult for anyone to timing the market, but there is always a way to identify the right investment property that will yield the most returns. Contact me, and I’ll share with you the additional considerations for selecting the appropriate investment property.