SINGAPORE, September 30, 2022 — Further cooling measures have been implemented by the government in order to temper housing demand and ensure that home purchasers finance responsibly in the face of rising interest rates. The set of measures released on September 29, 2022, includes loan quantum limitations that will affect both the private residential and public housing divisions. In addition, a new 15-month wait period will be implemented for private home owners and ex-private home owners to purchase a non-subsidised HDB resale apartment. (See the notice for further information.)

“The new requirements are not anticipated,” said Ismail Gafoor, CEO of PropNex Realty, “and we regard this as a timely and preventive effort to encourage more judicious borrowing among buyers for their property purchase, especially with interest rates set to rise higher.” The increase in the medium-term interest rate from 3.5% p.a. to 4% p.a. is expected but small, given the rate at which interest rates have risen (the 3-Month Compounded SORA has risen by more than 1% in recent months). Still, we predict that this will have an immediate impact on private house sales in the coming months as prospective purchasers examine their finances and weigh their options. The 0.5% increase in the medium-term interest rate may have a greater impact on the sale of new executive condominiums (EC), because EC buyers are subject to a harsher mortgage servicing ratio (MSR) of 30%, compared to 55% for private house buyers under the Total Debt Servicing Ratio (TDSR).”

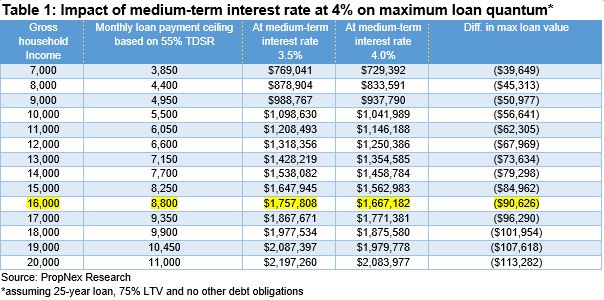

To compute TDSR using a higher medium-term interest rate floor

To illustrate, a buyer with a monthly household income of $16,000 will now be able to borrow approximately $1.667 million (assuming a loan tenure of 25 years, LTV of 75%, and no debt obligations) using a medium-term interest rate of 4%, compared to approximately $1.758 million previously – resulting in a loan quantum shortfall of nearly $91,000. (see Table 1).

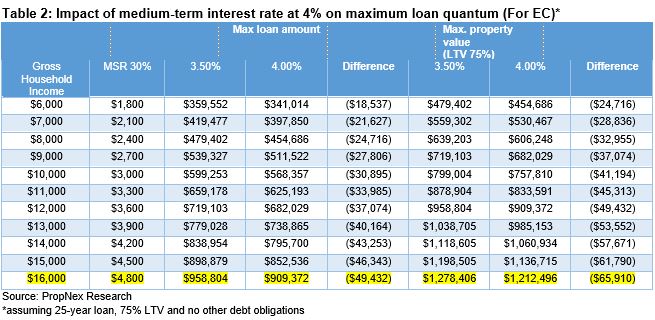

Higher Medium-Term Interest Rate Floor for TDSR Calculation – Executive Condos (EC)

Because EC buyers are subject to the 30% MSR, their loan amount will differ. Buyers with a monthly household income of $16,000 will be able to borrow about $909,300 at the revised medium-term interest rate of 4%, which is nearly $50,000 less than the previous loan amount of $958,800. (see Table 2). In terms of overall property price quantum, the EC buyer will only be able to purchase an EC unit for $1.212 million, as opposed to $1.278 million under the previous 3.5% medium-term interest rate.

The new set of cooling measures has also been calibrated to dampen demand for HDB resale flats and rein in the segment’s rapid price growth. In particular, for HDB loans, it will impose a 3% interest rate floor when calculating the eligible loan amount. Furthermore, the Loan-to-Value (LTV) limit for housing loans will be reduced from 85% to 80% (the LTV was reduced from 90% to 85% in December 2021).

Another measure will require private home owners and ex-private home owners to serve a 15-month wait period after selling their private properties before they can buy a non-subsidised resale flat. (The 15-month wait-out period does not apply to seniors 55 and older (and their spouses) who are relocating from their private home to a 4-room or smaller resale flat.)

“The measures are well-calibrated to curb exuberance in the HDB resale market, where strong demand has spurred a 12.7% price growth in 2021, and a further 5.3% rise in the first half of 2022,” said Wong Siew Ying, Head of Research and Content, PropNex Realty. In particular, more HDB resale flats have been transacted for at least $1 million – approximately 270 such flats have been resold in the year-to-27 Sep period, already breaking last year’s record of 259 units.

According to observations, some million-dollar flat buyers have sold their private homes and downgraded to such flats; flush with cash from the sale of their private property, such buyers are able to pay a higher price for the resale flat as well as cash-over-valuation. To some extent, this will level the playing field for other buyers of HDB resale flats, who may not have as large a war chest as the cash-rich downgraders who have sold their private home. The 15-month wait-out period is expected to cool demand from private home downgraders, but it may boost the leasing market, as those affected may have to rent before purchasing the HDB resale flat.”

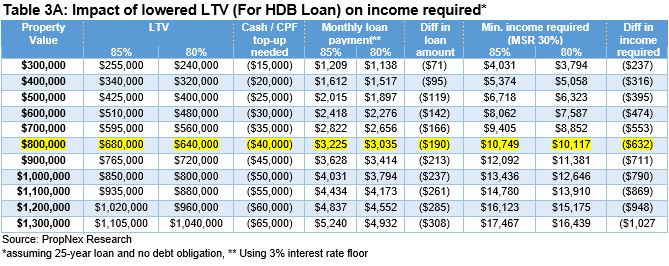

LTV Restrictions and the Interest Rate Floor Used to Calculate HDB Eligible Loan Amount

The measures will also have an effect on the amount buyers can borrow using HDB loans to purchase a HDB flat. For instance, a buyer who wishes to purchase a $800,000 HDB flat will only be able to obtain a loan amount of $640,000 – $40,000 less than before (see Table 3A). The required minimum monthly household income decreases to $10,117 based on a 30% MSR.

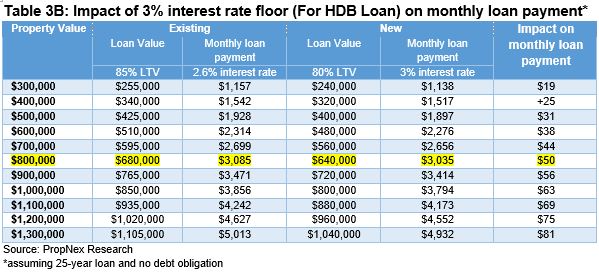

However, due to the stricter LTV limit that reduced the loan amount, the monthly loan payment that the borrower must make will decrease. Using the new 3% interest rate floor, the monthly loan payment for a $800,000 HDB flat will decrease by $50 to $3,035 (Table 3B) from $3,085 (calculated using a 2.6% interest rate).

Mr. Gafoor added, “The set of measures will impact both upgraders and downgraders. Those seeking to upgrade to a private residence will need to recalculate their finances to ensure they can make up the shortfall in loan amount caused by the 0.5%pt increase in the stress test interest rate. Buyers will have to pay more in cash or withdraw more from their CPF account to fund the purchase; they may also consider less centrally-located and smaller homes to maintain an affordable price level. Those seeking to downgrade from a private property to a HDB flat may have to postpone their plans or rent in the interim. We believe, however, that the HDB will be appealing to those who are experiencing financial hardship and must downgrade.

“The new measures are being implemented at a time when market sentiment has become more cautious due to rising interest rates and an uncertain global outlook.” We anticipate that developers will closely monitor sales in the coming months and will likely maintain stable prices. On the market for residential en bloc sales, we anticipate waning interest as developers digest the impact of these measures on housing demand.